As one reaches middle age, the general tendency is to start becoming more and more risk averse. This risk averse behavior is well evident in approach of 55 plus people towards investments in equities either directly or through related financial instruments. The popular misconception is that these type of investments are not at all suitable for 55 plus and retired persons. This comes from the widespread notion that equity-backed investments (in any form) are unsuitable for this population because of the underlying volatility and uncertainty in equities. In reality, this misplaced concern, pushes many middle aged people towards making financial decisions, which at best yield average returns that barely able to cover for price inflation.

In general, when one takes inflation and tax liability into account, bank FDs and similar deposits actually generate negative returns that doesn’t even cover the inflation rate and in effect, you lose value. The purchasing power of your money reduces at about the same rate as its value increases in a fixed deposit. The thing to understand here is that, even after retirement, a part of your corpus earmarked to be used after a long-term, around five years or more, should be invested in equity to get inflation beating returns. This article is intended to throw some light on one such equity linked investment option available to Indians – Equity Linked Savings Schemes (ELSSs). And if you have a taxable income, there is no better alternative than an ELSS.

We at Purnaa believe that spreading the word around about such misplaced concerns would help the population at large towards making the right choice. While it’s true that equity related investments are volatile, we do not advocate shutting doors completely. Some of the clear cut advantages of investments in ELSS are listed below:

Cushion against Equity Market Volatility

ELSS is an equity linked investment with a lock in period of 3 years from the date of investment. This protects retail investors from short term market volatility and helps in compounding profits from equity markets.

Tax Savings as 80C Investment Option

Can be considered as an 80C investment option while filing tax returns, thereby helping in tax savings. In Budget 2018, government has levied a 10% long term capital gains tax on earnings from equities and related investments. This means ELSS no longer have the earlier benefits where by the gains were tax free. LTCG would now apply to gains from ELSS like other investments. This is definitely a dampener but we still think this mode of investment would clearly outperform other investment options available to Indians.

Proven Outperformer

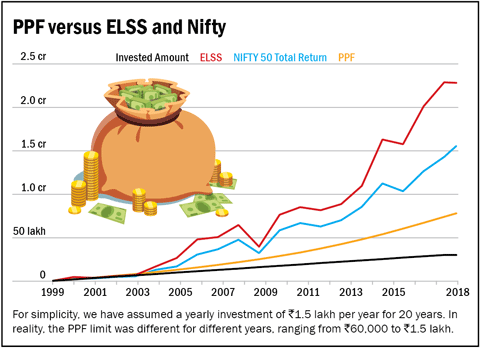

Popular Financial Website Value Research has done a research around how a SIP investment in an ELSS fund of an identical amount would have given an investor much higher returns compared to investments in PPF and Nifty. For the sake of parity, average returns of the ELSS category was considered. So, a Rs 1.5 lakh investment every year (making the total invested corpus Rs 30 lakhs) was considered, starting in 1999 and ending in 2018. The return on PPF came out to be Rs. 77.8 lakh, whilst an investment in an ELSS fund would’ve added up to a whopping Rs. 2.3 crore, almost 3 times higher! Whereas, simply investing in the index would have given a decent return of Rs. 1.5 crore, which is almost double the PPF returns. The post-tax returns on ELSS and index fund would be slightly lesser but they would still handsomely beat PPF returns.

For the original Value Research article please click here. This clearly points towards the fact that ELSS are a wonderful way of compounding one’s money over a period of time and therefore worth exploring.

Like all equity investments, the best way of investing in ELSS funds is through monthly SIPs throughout the year. However, a smaller number of evenly spaced investments are also suitable.